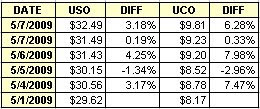

Following our UCO straddles posted last week, here are the current prices and ROI:

There is another one returning +40% so far. We expected oil to down down, yet it went up, likely due to the collapsing USD. With straddles, it does not matter.

| ||||||||||||

|

|

Shocked that companies and mutual funds would invest OPM (Other People's Money) in high-risk investments, the Shocked Investor was originally on a mission to find out if our money ended up in these dubious instruments. This blog now also discusses other financial topics, such as straddles, options, gold, natural gas, agri/food stocks, and the collapse of the US Dollar.

Following our UCO straddles posted last week, here are the current prices and ROI:

There is another one returning +40% so far. We expected oil to down down, yet it went up, likely due to the collapsing USD. With straddles, it does not matter.

Natural gas inventories were released today. The chart below shows the comparison between the current year and last year (red curve), as well as the 5-year average.

Note how the curve is sticking above the top of the 5-year average channel. Natural gas continues to be a great short here, particularly on this silly spike of $0.25 today (current price is $3.88). At this pace there will be no where to store it by the middle/end of ther summer.

Since we started posting about going short on NG a couple of weeks ago, we are up +40%/+50%.

Marc Faber's interview today with Bloomberg TV:

Mr. Faber says that right now we have a rebound from a low level.

- "We are and will be for years to come in a period of very high volatility, where+30/-40% will be common."

- "US will not default, but he is 100% sure the USA will go into hyperinflation, close to Zimbabue levels."

With the overextended runup in stock prices, here are attractive straddles for today. With expiration still 23 days away, the maximum moves required will be lower.

(please click to enlarge)

Straddles are calculated with the online StradlesCalc tool

US Treasury Auctions start today. These auctions used to be rock solid, but with the current crises, and a crises of confidence in the USD, there have been hiccups recently with foreigners not so keen to buy any more USD. Of particular worry are the longer term notes.

Calendar:

Tuesday: 2-year notes

Wednesday: 5-year notes

Thursday: 7-year notes

Total: $101B.

Historically, the 2-year notes have pretty much always sold well so no major surprises or very negative effects are expected with those. The real concern is with longer notes. If the auctions do not do well it signals a lack of confidence in the dollar. Either the USD will suffer, possibly quite badly, or interest rates have to rise signifcantly. Perhaps this is what is causing the lift in the US today (a preventive measure), and the decline in gold prices. Korean missile launches are also great for propping up the dollar in the short term.

Interest rates are not expected to rise any time soon. If the auctions are shaky, expect the USD to continue tumbling late this week and next week, with a corresponding rise in the price of gold, oil, and commodities.

The GDP of the countries of the Organization for the Cooperation and Economic Development fell 2.1% in the first quarter of 2009 relative to the previous quarter, according to preliminary studies divulged by the entity today.

This is about the biggest fall since that the OCED started to recprd the GDP data in 1960, and also the third consecutive fall since the third quarter of 2008.

Relative to the same quarter last year, the GDP of the same countries suffered a fall from 4.2%.

The most affected country in the three first months of 2009 was Japan, with a 4% fall, followed by Germany with -3.8%. After them, Italy fell - 2.4%, Great-Britain - 1.9%, United States - 1.6% and France - 1.2%.

Last week, Japan announced to have suffered in the first quarter of this year, the biggest contraction since these records started in 1955, because of the accentuated fall of country's exports.

Italy also announced that its GDP fell 5.9% in the first quarter of the year, in comparison the same the period in 2008, the worse fall since 1980.

Here are the price/earnings ratios of the S&P500 companies as of EOD May 22, with P/Es provided by Google Finance

Lowest P/Es:

(please click to enlarge)

Highest P/Es (and positive only):

Note that the above tables only compute the P/Es of the companies with positive earnings. The average of these is 40.99. Note that there are 114 companies with negative earnings. If these are computed, the average P/E would be in the hundreds.

You can view the complete list here.

NorthAmerican natural gas storage weekly inventories have just been reported. Stock piles are up +103Bcf, bringing the total stored to 2,116Bcf. Last year at this time it was 1,602Bcf. So we are 514Bcf higher, which is worth several weeks of the gas.

At this rate predictions are that there will be no place to store it by mid summer. If this happens, price will colapse. Buyers of UNG beware.

This chart compares the storage this year vs 52 weeks ago.

Please click to enlarge

These two companies have been discussed many times on this blog. Old historical rivals, Sadia and Perdigao, which trade on the NYSE as PDA and SDA, have announced a merger, creating a new world food giant, Brasil Foods. With US $ 22 billion revenue, the new business will be the 10th largest in the Americas. The two brands will be maintained.

Brazil Foods will be the largest industrialized food producer in Brazil, and the 10th largest in the Americas. They will be the world's number one in the processing of chicken meat. Popular and respected by consumers, the brands will be maintained as Sadia and Perdigao.

The transaction is being treated as a merger through an exchange of shares. The shareholders of Perdigao will get 68% of Brazil's Foods and Sadia's will get 32%. The two major shareholders of Sadia and Perdigão will remain predominantly in the new company. They are Previ, the pension fund of employees of Bank do Brasil, and the Fontana and Furlan families. The Board will have two chairmen, one from each side: Nildemar Secchi, of Perdigão, and Luiz Fernando Furlan, from Sadia.

In a second step, the deal provides for a public issue of shares, with the objective of raising around like $ 4 billion. The funds will be used to capitalize the company and try to compensate for the finances of Sadia, which enters the Brazilian Foods carrying a loss of $ 2.6 billion in derivatives exchange.

The transaction gives rise to a structure which employs about 100,000 employees, sells its products in more than one hundred countries and earned U.S. $ 22 billion last year. Within Brazil, the new company dominates over 50% of the market in various segments such as frozen meat, pasta and margarine.

The greatest transformation, however, should occur on the international scene. The expectations of analysts is that from now on Brazil Foods will focus abroad. One will sell the products of the other. The plan is to take the good image that Sadia built abroad. Today, its logo can be easily sighted in billboards on the streets of Baghdad or Moscow. One of the first steps, according to the shareholders of the new company will be to reassess two steps taken by Sadia due to the crisis: the sale of the Sadia factory in Kaliningrad, Russia, and the shelving of a new plant construction in the UAE .

Petrobras (PBR on the NYSE) signed a $10B financing deal with China's BDC (China's Development Bank). In exchange, PBR will provide China with 150,000 barrels per day in 2009, and 200,000 bpd in 2010. The agreement had been announced in February and has now been signed.

In addition. PBR, China Petroleum, and Sinopec have signed a cooperation agreement.

Petrobras also announced the discovery of oil in an abandoned well in the Santos Basin well at only 500m deep. Commercial viability has not yet been proven.

The Washington Post reports today that the town of Peru, Ind, was ordered by Congress to "buy American" when spending money from the $787 billion stimulus package. The town "stunned its Canadian supplier by rejecting sewage pumps made outside of Toronto". "After a Navy official spotted Canadian pipe fittings in a construction project at Camp Pendleton, Calif., they were hauled out of the ground and replaced with American versions. In recent weeks, other Canadian manufacturers doing business with U.S. state and local governments say they have been besieged with requests to sign affidavits pledging that they will only supply materials made in the USA."

So what happened next? The Canadians fired back. A number of Ontario towns, with a collective population of nearly 500,000, retaliated with measures effectively barring U.S. companies from their municipal contracts -- the first shot in a larger campaign that could shut U.S. companies out of billions of dollars worth of Canadian projects.

The Washington ost article also goes on to explain the case of an american company about to shut down plants and layoff American workers because of the the Buy American provisions. Duferco Farrell Corp. is on the verge of shutting down. With production among multiple nations, it makes coils at its Pennsylvania plant using imported steel slabs that not sold commercially in the US. Therefore the company's coils do not fit the current definition of "made in the USA". Its biggest client, a steel pipemaker located one mile down the road, told Duferco Farrell that it would be canceling orders. Duferco has had to dismiss 80 percent of its workforce.

"You need to tell me how inhibiting business between two companies located one mile apart is going to save American jobs," said Bob Miller, Duferco Farrell's executive vice president. "I've got 600 United Steel Workers out there who are going to lose their jobs because of this. And you tell me this is good for America?"

Stop this! This is the last thing we need.

We have posted here many articles warning against leveraged ETFs, starting in early 2008. The issue is that, in spite of all the recent warnings, common "mom & pop" investors still invest in these instruments as if they can be held for periods longer than 1 day. FairCanada today issued a report on the topic:

“Heads You Lose, Tails You Lose, The Strange Case of Leveraged ETFs”

FAIR Canada describes the hazards of investing in leveraged and inverse ETFs for periods longer than the daily performance that these funds promise. The 9 page report describes the growth of this very popular product in both the U.S. and Canada and how they pose threats to the health of investor portfolios.

LEVERAGED AND INVERSE ETFS ENDANGER INVESTOR FINANCIAL HEALTH

FAIR Canada Executive Director Ermanno Pascutto said: “The longer you hold a leveraged or inverse Exchange Traded Fund (ETF), the greater the likelihood that you will lose money, regardless of which direction you bet. For the 12 months ending March 31, 2009, the S&P/TSX index of gold-mining stocks was up 1%. The Horizons BetaPro Bear+ ETF lost 87%. The Bull+ fund lost 46%.”

Mr. Pascutto added: “These were not anomalies. Four of the nine pairs of Horizons BetaPro’s leveraged ETFs with at least a year-long track record lost money in both their bull and bear versions for the 12 months ended March. At least one member of virtually all of the other pairs suffered from significant tracking errors.”

A Very Rapidly growing and popular investment product

Leveraged and inverse ETFs are the most rapidly growing segment of the market. 32 Canadian funds, offered only by Horizons BetaPro, have pulled in $2.1 billion in investor dollars in the past 26 months and show up daily in the lists of top performing and most actively traded stocks. In addition, Canadian investors are purchasing U.S. leveraged ETF products. Offered by Rydex, ProShares and Direxions, these funds have attracted a total of US $33.2 billion in assets in the past three years. Definitions of leveraged ETFs and a table of their performance can be found in the appendices to this release.

ADVERTISING, PROSPECTUS DO NOT CONVEY THE TRUE RISKS OF LEVERAGED ETFS

”Come on” advertising campaigns on both sides of the border encourage investors to chase that popularity and top performance of a few funds. Leveraged ETF funds actually deliver their promised daily performance, but their marketing material omits performance data for longer periods. Boilerplate risk disclosure does not come anywhere close to conveying the true risks associated with speculating in these very powerful investment vehicles, and the high probability of losing money if they are held longer term.

FAIR CANADA CALLS UPON REGULATORS TO TAKE ACTION TO PROTECT INVESTORS

(1) Immediately require all leveraged and inverse ETF products offered in Canada to file a new prospectus. The prospectus should have bold front page disclosure, in plain English, of the risks of holding these products for longer than a few days, particularly in volatile markets.

(2) Insist on prominent disclaimers on all leveraged/inverse ETF advertising, both print and broadcast, with an explicit warning: This product is not suitable for holding periods longer than a few days, and is not appropriate for virtually all retail portfolios. Disclosure should be provided on the relevant company websites. Marketing materials should include references to the actual performance of the bull and bear versions of the ETFs over a period of one year and since inception. Simplify tables to make tracking error, leverage and volatility risks much more transparent.

(3) Warn registrants of the need to consider the suitability of these products for clients and to ensure that clients who trade the products understand the risks. Discount and execution-only brokers should communicate these risks to their clients.

(4) Study and publish conclusions on the actual uses of leveraged and inverse ETFs before clearing new offerings for sale to retail investors. We should know to what extent retail investors are trading and how long they are holding these products. With the drumbeat of the new triple-leverage ETFs now heard in the U.S., such a study assumes much greater urgency.

FAIR Canada Associate Director Steve Garmaise stated: “Despite recent warnings in the financial press on both sides of the border, many investors are unaware of the perils of holding leveraged or inverse ETFs for periods longer than a few days. The biggest problem of leveraged ETFs is simple: over time, they often don’t do what investors expect them to do.”

Mr. Garmaise continued: “One key lesson of the recent financial collapse is that markets do not self-regulate. Less sophisticated investors must be protected from financial ‘innovations’ that pose excessive risks to their savings while generating handsome returns for their sponsors. Just because something can be sold doesn’t mean that it should be sold - at least not without appropriate safeguards and warnings.”

Full report (pdf)

Marc Faber, editor and publisher of the "Gloom, Boom, & Doom Report", was on BNN today (watch). Interestingly, he was in the Swiss national ski team in his youth, when he used to ski and drink a lot. He still skis but says it is not as fast as he used to (but he still drinks a lot in the business world).

Some of his points today:

- Sees US deficits in the trillions for decades to come.

- Government bonds are the "short of the century".

- The USD is a doomed currency, as are most other currencies who are just printing and printing.

- Oils and minerals will appreciate

- Should start to nibble on real estate

- Technology: strong companies (MSFT, INTC, Infosys) will take market sgare

- Markets right now need a correction

- Right now not the best buying opportunity

Compared with recent months oil has been much more stable than it used to, and straddles are a little harder to come by. UCO is trading close to $10 making it ideal for a 9-11 June strangle or a 10-10 straddle. 9-11 is my preferred since there is lots of time to expiration. 10-10 is safer.

These are the maximum moves required computed with our StraddlesCalc tool.

9-11 Strangle:

10-10 Straddle:

The oil contango continues to narrow. The table below shows the contango changes in June to December contracts between May 7 and today. On May 7 the difference June to October contracts it was $4.01, now is around $3.46:

USO:

Oil has gone up in great part due to the recent decline in the USD. Nevertheless, declining contango is a bullish sign.

Nortel has just reported its results for Q1 2009. The company has revenues of just over $1.7B. Q1 revenue per business unit (in $M):

The company made no announcements of specific sales of its divisions, but said that assessments (by 3rd parties/buyers) are ongoing. It also said that it is decentralizing its global and common operations, which makes it easier for each unit to become fully standalone, a clear indication that the sales of its business units are ongoing.

At 9:35PM shares are oscillating around Friday's closing price of $0.30. With sales of $1.7B in the quarter, there clear value here. High gain, high risk.

UPDATE 10AM: There was a dip to $0.23 which presented a great buying opportunity, price recovered to $0.26/$0.27.

After the close on Friday, we now have 11 oversold companies whose RSI7 is under 30, and 205 overbought companies whose RSI7 is over 68. They are:

Oversold:

Overbought:

(please click to enlarge)

The most overbought company is GNW, Genworth Financial, with an RSI7 of 95.58. Its current price is $5.28. Chart:

In an article published today by O Estado de Sao Paulo, Joseph Stiglitz says that the crisis opens field for a new currency and that the system based on the dollar is falling to pieces.

Stiglitz says Brazil has space of maneuver in the monetary politics due its policy of high interests. Speaking in the Conferences of the Estoril, Stiglitz said that the Country is in capable of stimulating the economic growth by dropping interest rates. "A great advantage that Brazil has, curiously, is that the Central bank was excessively restrictive its monetary policy. One of the advantages to have high taxes of interest is that you can lowert them". In contrast, Europe and the United States do not have this possibility: "When it is arrives at zero, is has nowhere to go. Therefore, Brazil has space to maneuver in the monetary policy while the United States and the Europe do not" According to Stiglitz, Brazil has a privileged situation relative to the other countries because it can use exports as an impulse to leave the crisis.

"Brazil is one of the few cases where the recovery depends in some degree on the resumption of exports. But Brazil is a economy of great dimensions and exports have a relative weight."

Stiglitz believes that the crisis opens the way for the sprouting of a new international currency, with a global central bank. The proposal was formulated by the Chinese authorities. "The system based on the dollar is falling to pieces. I am the president of the commission of United Nations for the reform of the financial system and we are arguing the mechanisms through which this can happen."

He also said that the destruction of the subprime and derivatives market was a test of the idea that the market can regulate itself, and that it was a mistake. According to Stiglitz, another idea that did not work was of the economic darwinism: "They believed that there would be a natural selection, that the fittest would survive, but that was not what happen with American banks.

ROLLOVER MAY REPORT

USO rollover for May ended yesterday, Friday May 8 2009. This is what happened with USO and UCO during the rollover days:

There was only one down day. There was, of interest, one major intra-day drop with big volume.

We would conclude at this point that there were no major efefcts of rollover this time around.

CONTANGO

Also of interest is that there was a further reduction in the contango between June and October contracts. The difference is now $3.26, down sharply from $4 yesterday. Note how all future months had a drop in price, while the front month of June saw an increase in price.

ROLLOVER CALENDAR

Here is the rollover calendar:

For reference, we reproduce the April and May effects.

April effects:

March effects:

This is a follow-up o our recent post on Nortel as a good speculative stock. Today the price has risen +25%, on high volume. The company will be reporting Monday.

Lunch money is on the house.

Today is the last of the 4 days of the monthly USO rollover of contracts. Yesterday this seems to have been accomplished by a rather large dump around 1PM-2PM:

We are watching carefully.

UPDATE 4:30PM:

The following chart shows what happened today. There does not seem to be any visible activity or effect due to rollover:

Activity for the last 5 days, 4 of which were rollover days:

The Financial Times has a very interesting shockwave application showing how the top banks by market capitalization have changed for the last few years. You can clearly see the Goldman Sacks ascension and the decline of the American banks.

- In 2005 GS was ranked 19th out of the 20 largest. Today it is ranked 8th.

- In 2005 there were no Canadian or Brazilian banks in the top 20, today there are 4.

- In 2005 there were no Chinese banks, today there are 5.

- In 2005 there were 10 US banks in the top 20, today there are 3.

Please click on images to enlarge. $ shown are in Billions.

2005:

2006:

2007:

2008:

2009:

The Bank Stress has been finally released by the Fed. You can download the entire document here or read it below.

10 U.S. banks need to raise a total of $74.6 billion in capital, whichChairman Ben S. Bernanke claims will "reassure investors about the soundness of the financial system"! No kidding.

The results showed that losses at the banks under “more adverse” economic conditions than most economists anticipate could total $599.2 billion over two years. Mortgage losses present the biggest part of the risk, at $185.5 billion. Trading accounts were the next highest risk, with potential losses of $99.3 billion.

You can scroll, zoom, flip through pages, right on the screen below.

Bank Stress

If you are still invested in natural gas, today may be a great time for an exit. An injection of 95Bcf was reported today. The storage curve is still looking awful, numbers are significantly higher than last year and are touching the top of the 5-year channel:

BNN interviewed two natural gas experts today. One is slightly bullish (Ira Eckstein, Area International Trading) the other one, Randy Ollenberger from BMO, sees real danger of natural gas prices touching a $2 handle. Prices have run from $3 last week to over $4 today! You can watch the show Commodities Report here.

As of 1:01PM:

On April 20 we commented on the UCO straddles for May.

Here is an update:

7.50/7.50 Straddle:

Then, as posted:

Today:

Calls: 2.40

Puts: 0.10

ROI: +78%

6-9 Straddle:

Then:

Today:

Calls: $1.00

Puts: $0.00

ROI: +65%

Actual move on the underlying was +31%.

The markets are well into overbought territory according to the RSI7 indicator. Here are the numbers as of the close yesterday:

SPY: 79.60

IWM: 73.38

XLF: 74.42

DIA: 79.65

Oil and Natural gas:

Oil is overbought, natural gas is almost there.

USO: 72.95

UNG: 67.46

Note that we are in the middle of the USO rollover. Any spike up today could be a golden opportunity to short oil, if the pattern repeats from previous rollover months.

Biovail announced results today, beating by $0.12, but missing on revs Reports Q1 (Mar) earnings of $0.42 per share, revenues fell 16.9% year/year to $173.3 mln vs the $176.9 mln consensus. More importantly, the company announced it is lowering its quarterly dividend to $0.09 per share.

As a result, the stock is down 14%.

The earnings straddle is returning +125% profit as of 11:30AM. You can track them here.

The table belows shows the average 1-year volume of DIA, SPY, XLF and IWM, as well as the average for the last 30 days and the volume Tuesday May 5.

There are very significant declines in trading volume, particulary with the most popular ETFs, SPY and DIA. A rally without volume is one to be very worried about. Is the current rally being fabricated, or have investors simply lost their money and can't get back in the market, or have they lost faith in the stock market?

Please see the volume in the charts below (kindly click to enlarge):