President Obama announced today the expansion of off-shore gas and oil exploration, opening up vast areas o the ocean North of Delaware to Central Florida, and Also Alaska. Certain areas will remain protected, such as Bristol Bay in Alaska, from New Jersey north to Canada, and the Pacific coast from Canada to Mexico.

This is a long term proposition. Two companies that may benefit from this in the long term were recommended on BNN today by Kevin Cook, market analyst with PEAK6 Investments.

They are Transocean (RIG) and Diamond Offshore Drilling (DO). Both have been beaten down lately.

As mentioned, these are long term prospects. RIG, for example, still has lot of drilling equipment idle.

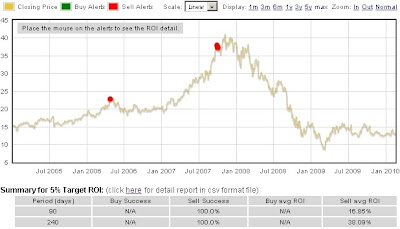

RIG

Transocean Ltd. provides offshore contract drilling services for oil and gas wells worldwide. The company offers deep water and harsh environment drilling, oil and gas drilling management, and drilling engineering and project management services, as well as explores, develops, and produces oil and gas resources. As of December 31, 2008, it owned and operated 136 mobile offshore drilling units comprising 39 high-specification floaters, 28 midwater floaters, 10 high-specification jackups, 55 standard jackups, and 4 other rigs, as well as 10 ultra-deep water floaters under construction or contracted for construction. The company was founded in 1953 and is based in Vernier, Switzerland.

RIG had revenues of $11B in 2009 and has a market cap of $27.78B.

It's forward P/E (fye 31-Dec-11) is 7.95.

DO

Diamond Offshore Drilling, Inc. operates as an offshore oil and gas drilling contractor worldwide. The company provides offshore drilling services in the deep water, harsh environment, conventional semisubmersible, and jack-up markets to independent oil and gas companies and government-owned oil companies. As of December 31, 2009, it operated a fleet of 47 offshore rigs consisting of 32 semisubmersibles, 14 jack-ups, and 1 drill ship. The company was founded in 1989 and is headquartered in Houston, Texas. Diamond Offshore Drilling, Inc. is a subsidiary of Loews Corporation.

DO has a market cap of $12.35B and had revenues of $3.6B in last fiscal year. Its forward P/E is 9.86.